Meny

This is how we calculate - days and money

You can get compensation for a maximum of 300 days. You can receive benefits five days a week and the maximum compensation paid is SEK 1,200 a day before tax. Each benefits period starts with two qualifying days.

Waiting period of 2 days

Every 300-day compensation period begins with stwo qualifying days "karens". The qualifying period is mandatory. You will not be compensated for a qualifying day, even though you are unemployed and otherwise meet the conditions. The qualifying time must be fulfilled within a twelve-month period.

300 days, 5 days a week

A period consists of 300 pay days, 450 days for parents with children under the age of 18. At most, you can get five days per week. Every unemployed day for which you receive benefits will be counted off from the period. Days for which you are not reimbursed will not be deducted from your period, for example, if you work, are ill or on parental leave.

If you are unemployed full time, a period is approximately fourteen months. You will continue on the same period that you have previously begun, if you would need benefit again within 12 months.

Should your be away longer than twelve months you have to meet the conditions again for entitlement to benefits. In order to continue the period you have started, the interruption must consist of time of compensation from Försäkringskassan, parental leave or studying. Please contact us.

60 weeks if you work

You are entitled to combine work and unemployment benefits for a maximum of 60 weeks.

Member for 12 months or more

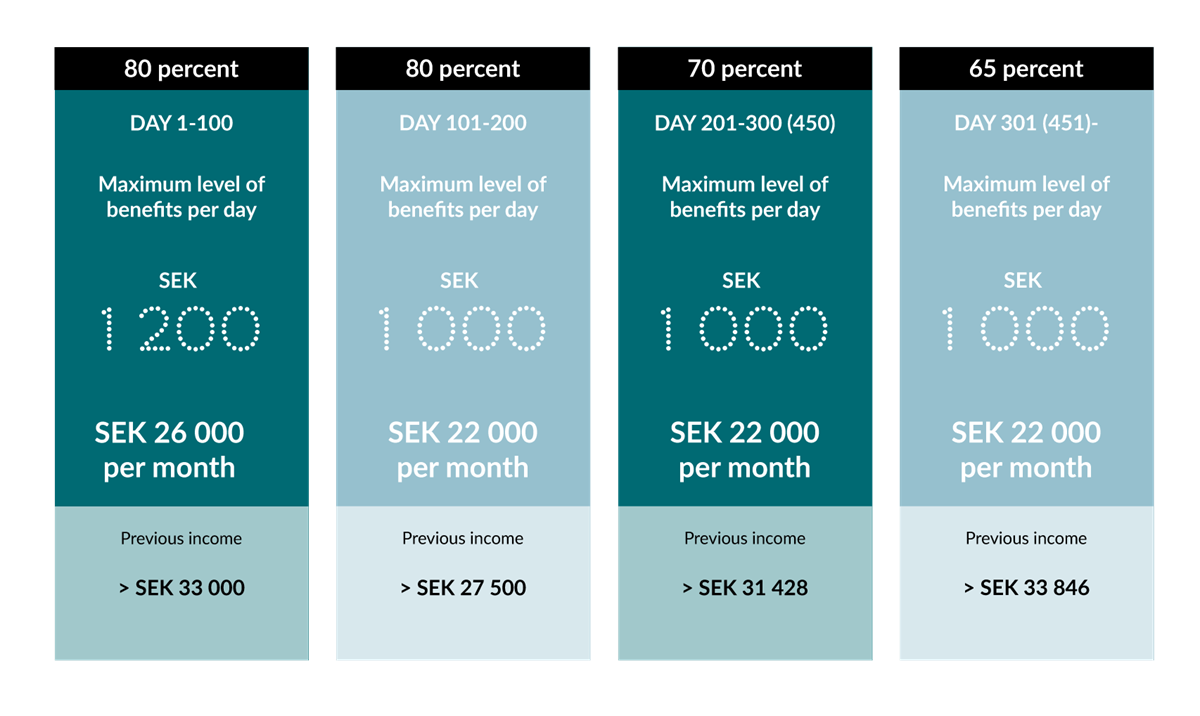

If you have been a member for at least 12 months, you have the right to income-related benefits if you meet the working conditions during the membership period. The level of compensation is 80 percent the first 200 days of benefits.

At the most you can get SEK 1,200 a day. You receive SEK 1,200 if you had an average monthly salary of at least SEK 33,000 twelve months before the unemployment. After the first 100 days, the maximum daily allowance is reduced to SEK 1,000 and after 200 days, the level is reduced to 70 percent.

Member less than 12 months

Even those who have been members for shorter time than 12 months may receive benefits. Your compensation will be based on how much you have worked. The maximum level of benefits is SEK 510 a day before tax. When you have been a member for 12 months, we will automatically check if you are entitled to benefits based on your salary and then the maximum payment is SEK 1,200.

This is how we calculate

Both your working hours and your salary are important when we calculate your level of compensation. Your average working time is important for how many days of payment per week you can get if you combine work and benefits.

The benefits is always an average of the income for the 12 most recent months. We always divide your income by 12. If you for example have worked for eight months we divide the total income by twelve. That is why it is important that you send us certificates from your employer for all the time you have worked, not just the time to meet the conditions.